Polychrome Developer Tools Index: Financial Planning

An overview of financial planning and reporting, and Q2 update to the Polychrome Developer Tools indices

“Capital allocation is the most important job of the CEO” - William Thorndike

This post is arriving a little late, as Q2 ended on June 30th. Why? Because as soon as Q2 ended, the Polychrome team has been heads down planning for Q3 and the rest of the year. Our public companies also get this luxury; their quarters (mostly) ended in June but earnings have not yet been announced. They have been planning too. This quarter, our developer tools blog post will dive into all this financial planning.

Financial Planning Basics

Each year companies build a detailed financial plan to help them forecast the needs of the business, and to track against, throughout the year to make sure they are meeting their goals. These plans are very detailed, rolling up the Plan for the full Income Statement, Balance Sheet, Cash Flows, and Key Metrics such as NRRR (if you haven’t read it, our Q1 post on NRRR is definitely worth checking out).

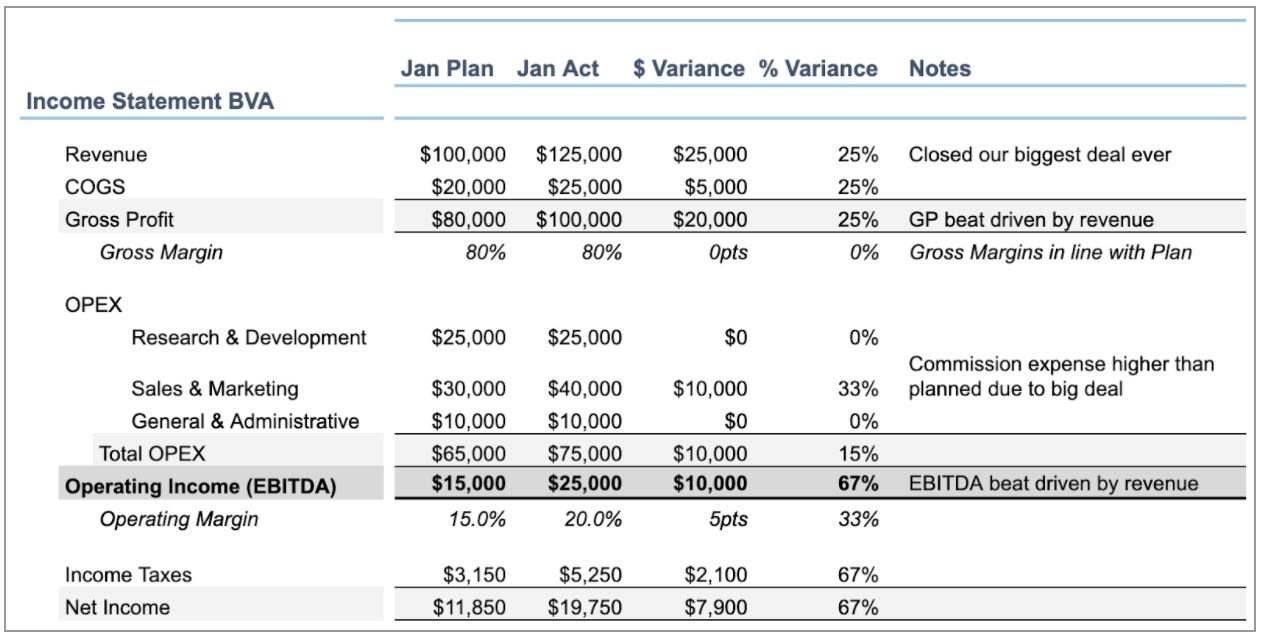

To make this more concrete, here is an example of a really basic Income Statement Plan:

As the year goes by, each month and quarter companies compare their progress against Plan, in what is called a Budget Versus Actuals (BVA) exercise. This exercise is really important to keep track of what is going on in the business.

To make this more concrete, here is an example of a BVA after January, using our Plan above:

In a fast moving startup, the Plan you made in Dec ‘20 for 2021 can start to look pretty far from reality by Mar or Jun ‘21. This is where new Forecasts and even Updates are utilized, and why I mentioned we were doing so much planning here in early Q3 ‘21. The way to keep track of all of this is to have strict naming conventions, here’s the best practice:

Type. There are three types

Plan is set at the beginning of the year and never changes. This way the target never moves and you can always compare back to Plan.

Forecast is updated monthly to help you make decisions in real time throughout the year. They are not used to compare against, just to operate against.

Update is quarterly or half-yearly depending on the need. You create an Update when things are really going differently than you had predicted and it doesn’t make much sense to do a BVA strictly against Plan anymore.

Month. To show which month each version is, use the number of months actuals + number of months forecasted.

Examples: Plan 0+12, Forecast 1+11, Forecast 2+10, Update 3+9.

Remember the purpose of each type and use them correctly.

Why Financial Planning Is Important

This is all a decent amount of work, so why is everyone bothering? Simply put, determining how resources are used is the most important decision a management team makes. Or as author William Thorndike put it, “Capital allocation is the most important job of the CEO”. Carefully planning the resource allocation, tracking the results, and adjusting your course based on results are critical tasks to managing a business.

It also helps hold you and your team accountable to results. In most cases it won’t just be for you, there will also be the board and investors looking to hold you accountable. For public companies this comes in the form of quarterly earnings and guidance.

Guidance and Earnings

You can bet our Polychrome Developer Tools Public 20 Index companies keep a tight eye on their guidance and results. Let’s see how they report earnings and guidance, and what this can teach us. To simplify things I will just focus on Revenue, although guidance is often given for everything down to earnings per share (EPS).

The first thing that I notice is that not one of these companies missed guidance. This is a critical difference between an internal Plan and external guidance. Usually a company's public guidance is a very conservative outlook, this is because Wall Street really punishes you if you miss guidance. The outlook you give to private investors might be a bit less conservative, but you still want to have a high confidence level in your ability to achieve or over-achieve what you share with them. Then there is your internal Plan. This should be your best possible estimate of what will happen - that’s because you’re using this to set goals for teams and to allocate resources. Too conservative and you will probably under invest in growth. Too optimistic and you might find your burn rate getting ahead of the business.

The next thing I took a look at was how the stock reacted in the week following earnings. Below I graphed the comparison of a company's earnings beat vs. stock reaction the following week. I would guess this is not correlated (as long as everyone beats guidance), because analysts know that plans are conservative and know which companies are more or less conservative and react accordingly. Looking at the chart below, it turns out there is some correlation, especially on the low end as a company is close to being within their guided range. Also, there are a million other factors, including those that explain why most of these stocks were down; so this is more an interesting note than a thesis.

Polychrome Developer Tools Indices Q2 Performance

Now that we know that all it takes to have your stock go up is the classic under-promise, over-deliver, let’s see how well our portfolio companies did in executing that strategy! We have now been following these two indices for 6-months, so each update is quite interesting.

Polychrome Developer Tools Public 20

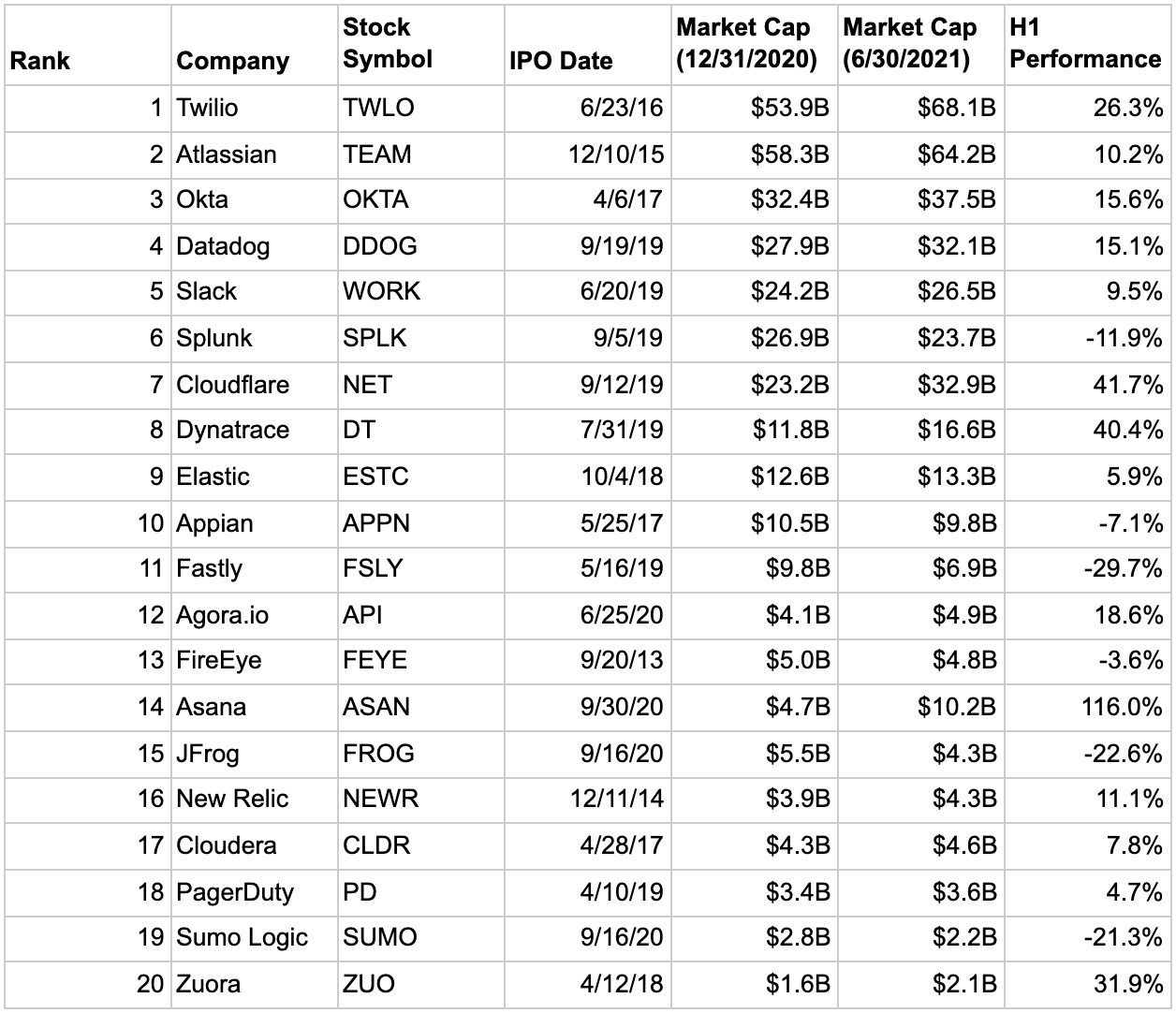

This list is the most valuable 20 developer tools companies, by market cap, which initially listed their stock publicly within the last 10 years - (as of Jan 1, 2021). The update we will track here is market cap, and compare the performance vs. other indices over the quarter.

The Polychrome Developer Tools Public 20 index bounced back in Q2, moving from down 6% in Q1 to up 14% for H1. This is great return, but as you can see from the comps it’s generally in line with the market.

The companies are starting to separate themselves in terms of returns when you look at individual stocks. Remember, this is just 6-months though, and we think about these companies as building value over the long term. Check out the H1 performance by the company below.

Polychrome Developer Tools Private 30

This list is the 30 most funded developer tools companies, by dollars raised, which remain private - (as of Jan 1, 2021). This updates total funding, valuation range, and shares a few items to note.

Again, the private company valuations are less volatile as compared to public stocks. Q2 didn’t have quite as much fundraising activity as Q1, but it was still good for this group.

Five companies raised nearly $700M in capital in Q2 2021, taking the total funding of the index from $7.4B at the beginning of the year to just over $10.0B (excludes DOCN).

I hope you all enjoyed the read and have a basic understanding of how financial planning works and why it is important! Please comment on the next topic you would like to dive into.

Thanks,

Alex